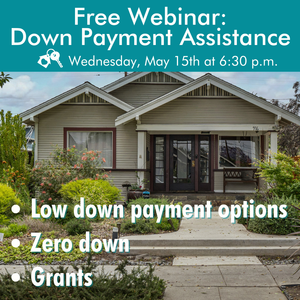

Buying a home can be overwhelming and expensive! But Down Payment Assistance Programs can help by providing an opportunity to buy a home with lower out-of-pocket costs. Finding, applying for and getting money from these programs can be a challenge, however. Funds for these programs can go quickly, and if you’re not poised to take advantage of them when they are available, then it’s easy to miss out. If you’ve been struggling to save enough money for a down payment, then be sure to join us for a Free Down Payment Assistance Webinar at 6 p.m. Pacific time on Wednesday, May 15th.

Highlights from our Upcoming Down Payment Assistance Webinar

- There are a number of down payment assistance programs and your location, loan amount, credit score, and income will determine what you qualify for. The best thing to do is connect with a lender who is well-versed in available programs so they help you determine what program will be the best fit.

- Did you know that less than half of home purchases are made with 20% down or more?

- If your loan amount is $766,550 or less, you can put as little as 5%, and even 3% in some cases.

- If you qualify for an FHA loan (a type of down payment assistance program) you only need to put 3.5% down.

- Don’t forget that the down payment isn’t the only payment you need to consider. You also need to account for closing costs and having a reserve of money once the buying process is over.

- It is so important for buyers to educate themselves on what is required. Even with the right experts on your team, it’s still important that you understand the process. You don’t want to sign anything you don’t understand.

- Curious about which loan programs you qualify for? Call a lender and they can help you find out. If you need help getting in touch with a trusted mortgage broker please reach out to us.

Links

Here are some useful links:

Ready to Buy a Home?

While down payment assistance programs are an important part of the process, there’s much more to buying a home! Check out these other helpful topics we’ve covered in our Home Buying 101 video series:

- 3 Mistakes That Will Derail Your Mortgage Application

- Buying A Historic Home In Long Beach CA

- How Much Do Interest Rates Really Impact Your Monthly Payment?

- Knowing How Much to Offer

- Questions to Ask At An Open House

When you’re ready to buy a home we’ll be here for you. Please fill out the form below to get started or give us a call at 562.896.2456.