The coronavirus pandemic has led businesses all over the nation and locally here in Long Beach to reduce or discontinue their services altogether. Many people have been laid off or furloughed. Naturally, the economic impacts of the pandemic have some people believing we might see a rush of foreclosures like there were in 2008. However, the market today is very different from 2008 and those fall foreclosures might not be coming.

There are two reasons we don’t expect to see a rush of fall foreclosures: forbearance extension options and strong homeowner equity.

1. Forbearance Extension

Forbearance, according to the Consumer Financial Protection Bureau (CFPB), is “when your mortgage servicer or lender allows you to temporarily pay your mortgage at a lower payment or pause paying your mortgage.” This is an option for those who need immediate relief. In today’s economy, the CFPB has given homeowners a way to extend their forbearance. This greatly assists families who need it at this critical time.

Under the CARES Act, the CFPB notes:

“If you experience financial hardship due to the coronavirus pandemic, you have a right to request and obtain a forbearance for up to 180 days. You also have the right to request and obtain an extension for up to another 180 days (for a total of up to 360 days).”

Many states and cities have moratoriums on evictions and foreclosures extending into the fall. It seems that we have perhaps learned from 2008, and are better prepared to prevent fall foreclosures.

2. Strong Homeowner Equity

Equity is also working in favor of today’s homeowners – another reason we don’t expect to see substantial foreclosures in the near future. Today’s homeowners who are in forbearance actually have more equity in their homes than what the market experienced in 2008.

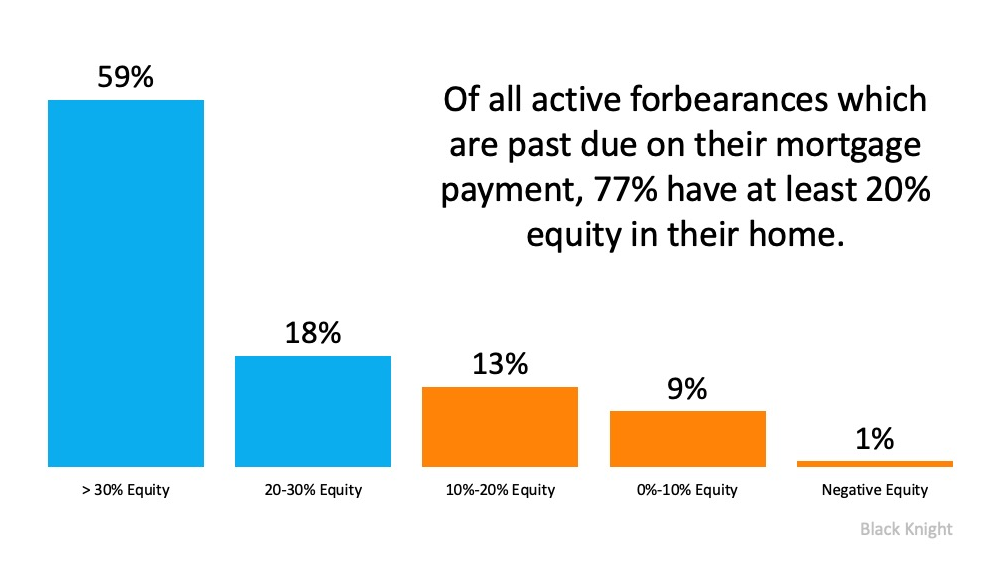

The Mortgage Monitor report from Black Knight indicates that of all active forbearances which are past due on their mortgage payment, 77% have at least 20% equity in their homes. (This is illustrated in the graph below.)

Black Knight notes:

“The high level of equity provides options for homeowners, policymakers, mortgage investors and servicers in helping to avoid downstream foreclosure activity and default-related losses.”

In 2008 we saw many homeowners walk away because they owed more than their homes were worth. This time, the real estate market is very different. Equity is stronger and plans are in place to help those affected weather the storm.

If You’re Waiting to Buy a House

Be sure to consider why you’re waiting to buy. Are you still saving up for the down payment? Are you locked into a lease? Unsure about your job or where you want to live? These are great reasons to wait to buy a home. However, if you’re waiting for fall foreclosures, you may want to reconsider your timeline.

Mortgage rates are at an all-time low and should definitely be a factor in your home search. Taking advantage of these low rates can save you money without having to buy a foreclosed home. In fact, banks want to get as much money as possible for the homes they foreclose on, so you may be waiting for something that wouldn’t turn out to even be a great deal.

It’s true that inventory is low and the market is considered a seller’s market right now. However, this is just another reason to stop delaying your search. If you have a trusted Realtor on your side, they will be on the lookout for your dream home. A local agent who is tapped into the market may even know about properties before they go up for sale, giving you a leg up. After all, are you more interested in buying a home that meets your needs or one that happens to be a foreclosure?

If you’re ready to get started with this process, please fill out the form below or give us at call at 562-896-2456. We look forward to hearing from you!