At this point, most people are aware that the 2021 housing market is like no other. Home prices are skyrocketing, interest rates are at record lows, and bidding wars are still common among house hunters. Many potential home buyers are contemplating whether or not they should just “wait it out” and buy a home next year, assuming that the prices will drop. The problem is, that’s very unlikely to happen.

Two Reasons Why Waiting a Year To Buy Could Cost You

If you’re a renter with a desire to become a homeowner, or a homeowner who’s decided your current house no longer fits your needs, you may be hoping that waiting a year might mean better market conditions to purchase a home.

To determine if you should buy now or wait, you need to ask yourself two simple questions:

- What will home prices be like in 2022?

- Where will mortgage rates be by the end of 2022?

Let’s dive deeper into both of these questions by looking at housing market statistics.

What will home prices be like in 2022?

Three major housing industry entities project continued home price appreciation for 2022. Here are their forecasts:

- Freddie Mac: 5.3%

- Fannie Mae: 5.1%

- Mortgage Bankers Association: 8.4%

Using the average of the three projections (6.27%), a home that sells for $350,000 today would be valued at $371,945 by the end of next year. That means, if you delay, it could cost you more. As a prospective buyer, you could pay an additional $21,945 if you wait.

Where will mortgage rates be by the end of 2022?

Today, the 30-year fixed mortgage rate is hovering near historic lows. However, most experts believe rates will rise as the economy continues to recover. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

- Freddie Mac: 3.8%

- Fannie Mae: 3.2%

- Mortgage Bankers Association: 4.2%

That averages out to 3.7% if you include all three forecasts, and it’s nearly a full percentage point higher than today’s rates. Any increase in mortgage rates will increase your cost.

What does it mean for you if both home values and mortgage rates rise?

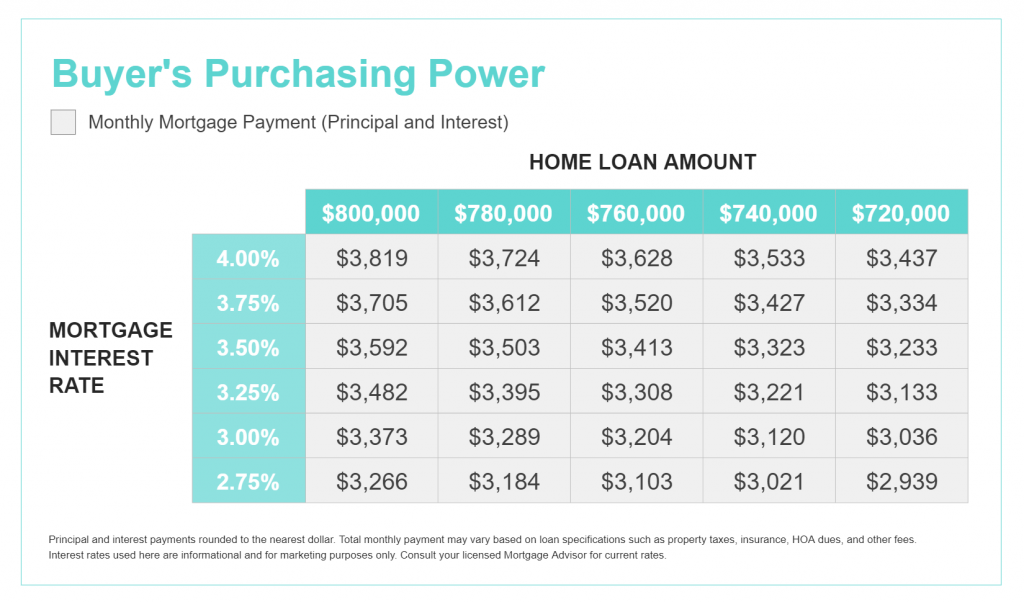

You’ll pay more in mortgage payments each month if both variables increase. Let’s assume you purchase a $720,000 home and interest rates rise from 2.75% to 3.75%. Instead of paying a $2,939 monthly mortgage payment, you’d then pay a $3,334 monthly mortgage payment. The difference in your monthly mortgage payment would be $395 which is $4,740 more per year.

Purchasing now will allow you to take advantage of the equity you’ll build up over the next calendar year for a house with a similar value.

Non-financial benefits are a driving motivator when asking yourself “Should I buy a home?”. But, when it comes to the question “When should I buy a home?”, financial benefits play a huge role. Based on the housing market forecast, it’s clear that buying a home now is much more financially advantageous, than waiting another year.