When the pandemic hit and many homeowners entered forbearance programs in 2020, people started asking the question “When is the wave of foreclosures coming?”. Even though many were concerned that we’d experience a housing crash when forbearance plans ended, here’s why the current situation is different from 15 years ago.

1. Fewer Homeowners are in Trouble

In 2008 when the housing market crashed, over nine million homeowners lost their homes to foreclosure or short sale. The reality today is that most homeowners who’ve exited their forbearance program are either fully caught up on payments or have negotiated a repayment plan with their bank. Here are the statistics:

- 38.6% left the program paid in full

- 44% negotiated repayment plans

- 0.6% sold as a short sale or did a deed-in-lieu

- 16.8% left the program still in trouble, without a loss mitigation plan

2. Repayment Plans are Still Negotiable

There are 890,000 mortgages currently in forbearance, and those homeowners still have the opportunity to negotiate a suitable repayment plan with their lenders servicing company. The servicing companies are actually under pressure by both federal and state agencies to work out those plans in order to limit foreclosure activity in 2022.

3. There’s a Surplus of Equity

Many of the 16.8% that have left their forbearance program without a plan have enough equity to sell their home instead of facing foreclosure. Over the past 2 years, rising home prices have left homeowners with record-breaking gains in equity. According to CoreLogic, the average American homeowner gained $56,700 over the past year.

4. There Have Been Fewer Foreclosures

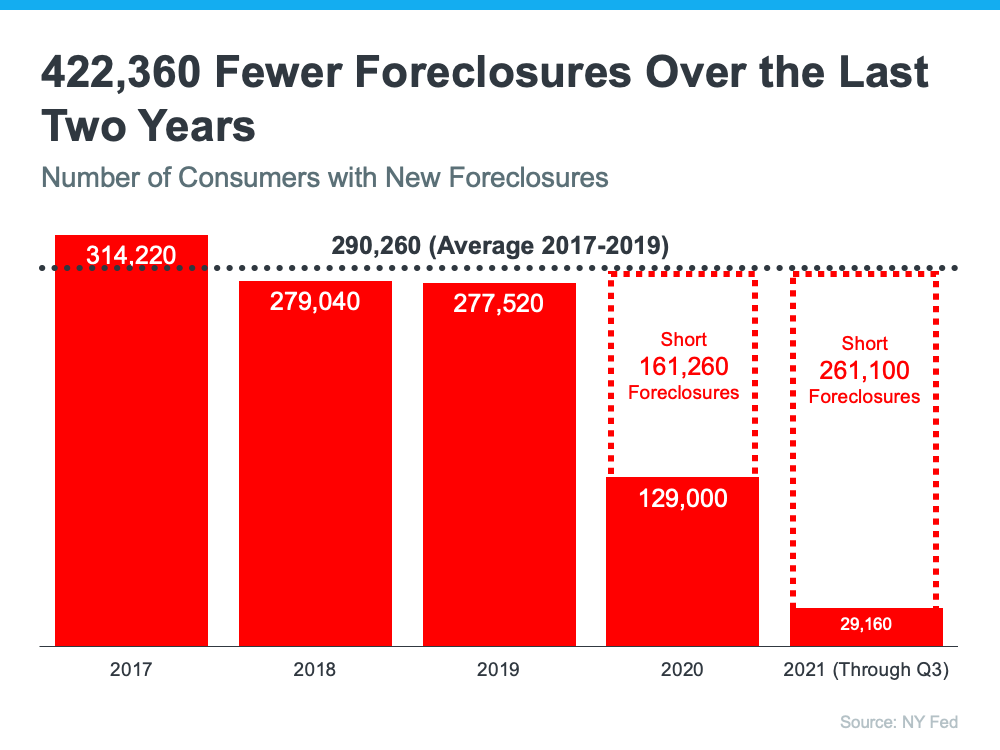

Over the past two years, the forbearance program prevented 400,000 foreclosures that would have normally happened if the plan wasn’t in place. From 2017-2019, the average number of foreclosures was 290,260 per year. In 2021, there were only 29,160 foreclosures! Here’s a graph illustrating the data:

Foreclosures Over the Last 2 Years

5. The Market Can Absorb New Listings

When the housing bubble popped in 2008, there was an oversupply of houses so when the foreclosures hit the market there was a nine-month supply of listings. The current housing market is severely lacking supply. Even if one million homes entered the market, there still wouldn’t be enough supply to meet buyer demand.

If you have any questions about the real estate market in Long Beach, give us a call at 562-896-2456!