In this housing market prices are constantly on the rise. Combine that with Southern California’s well-known top-dollar real estate price tags, and houses can put you back a pretty penny. Therefore, local buyers can find themselves wondering exactly how much money they need on hand to invest in the home of their dreams. When you combine the considerations of a down payment, the spectrum of closing costs, and other assorted cash requirements, the amount of money a buyer needs to have on hand to purchase a house adds up to more than a simple sum. Here’s how much money you really need to buy a home.

Down Payment Amount

Your down payment can range from $0 dollars (for VA loans) up to 20% of the total cost or more. Lenders determine your risk as a borrower in part by the amount of your down payment. Typically, loans with higher down payments and lower loan to value (LTV) ratios come with lower interest rates. Some people assume that because of that, they must wait to buy until they have 20% down. However, if interest rates rise in the meantime, saving more before buying may not actually save you money in the long run. Working with an experienced Realtor with great lender relationships can help you determine the right course of action. They can also help you discover the range of buyer assistance programs available, and the right down payment percentage based on your needs.

For more information on saving for a down payment and how much that can vary state to state, please visit our recent blog post.

Closing Costs

According to a survey conducted by ClosingCorp, over half of all homebuyers are surprised by the closing costs required to obtain their mortgage.

After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all. Another 35% were stunned by how much higher the fees were than expected. Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance, and appraisal fees.

Recently, Bankrate.com gathered closing cost data from lenders in every state and Washington, D.C. They used this information to estimate the percentage of closing costs based on a variety of factors and even include some helpful calculators.

Lender Required Cash Reserves

Sometimes a lender-required cash reserve requirement can take buyers by surprise. While it’s not technically a “closing expense,” lenders may expect you to have a certain amount of money held in reserve in your savings beyond the down payment and closing costs. They want to see this so they know that you have enough cash to make your mortgage payment during the first few months. A typical requirement is around two months, but it can vary. Remember, this is not an actual deposit. The lender only needs to be able to verify that your cash is available in a liquid form. However, if you’re considering how much money you really need to buy a home, it’s not a bad idea to keep this in the back of your head.

Perspective From A Local Lender

When it comes to determining how much money you really need to buy a home, “there’s no blanket way to determine the closing costs,” says Traci Stier, mortgage lender at Arbor Financial. In fact. she says asking for a set percentage based on the price of a home is almost a “loaded question.” Different people define closing costs in different ways. Some people want to include the home inspection or appraisal fees in this number and others don’t. So it really depends on everyone’s individual situation. The best course of action to determine your closing costs? Traci suggests talking to a lender for individualized advice. There’s no magic number or calculator for how much closing costs will be. However, a lender will be able to give you a better idea and walk you through the mortgage process step by step.

An Example Scenario of Down Payment & Closing Costs

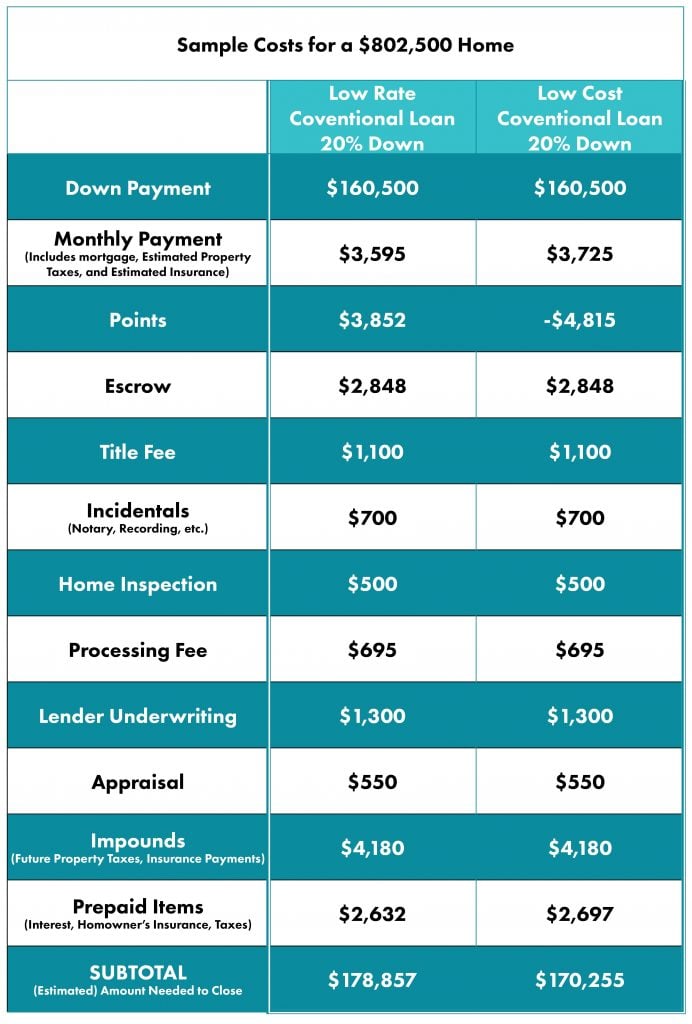

Let’s consider that you decide to put 20% down on a home priced at $802,500. (This is the median home price in Long Beach right now.) Given that scenario, your down payment would be $160,500. Closing costs would then add about another $10,255. Therefore, your combined out-of-pocket cost would be about $170,255.

Below is an example worksheet showing you some typical costs. However, keep in mind that interest rates fluctuate, lenders’ charges vary. This chart is based on an interest rate of 2.875% for the low rate loan and 3.25% for the low cost loan. Please note that interest rates do fluctuate and you are advised to consult with a lender about specific rates and terms.

Need Help Figuring Out How Much Money You Really Need to Buy a Home?

As with any financial transaction, everything will need the experienced eye of a professional to direct you on the right path. The good news? We’re here to help! We’d be happy to set up a complimentary appointment to discuss your individual needs. Once we have a better idea of where you’re at, we can refer you to a great lender. They can help you figure out your budget which in turn will help us find houses to show you! Just contact us below or give us a call at 562.896.2456. Together we can map out a plan to finding and buying the home of your dreams!

Leave a Reply