Starting out on your home buying journey can be both exciting and nerve-wracking. You likely have what feels like a million questions, and that’s completely normal! One of the most common questions for a potential home buyer is, “How much do I need to save for my down payment?”. The amount you’ll need to save for your down payment is determined by your financial situation, the housing market you’re looking in, and how much you’d like to pay each month for your mortgage.

If you think you have to put 20% down, you may have set your goal based on a common misconception. According to Freddie Mac, “The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.” Unless your loan type or provider requires you to put down 20%, it’s not typically required.

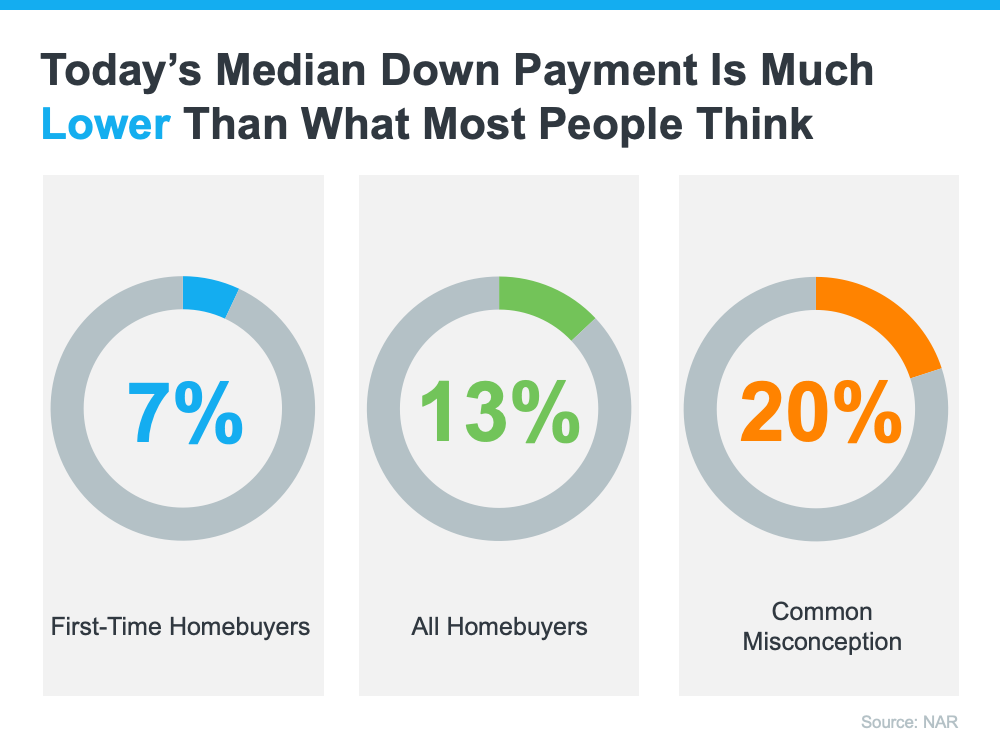

Of course, there are benefits to putting down 20% on a home, like avoiding private mortgage insurance (PMI) and a lower overall payment. But, here’s the reality – according to the National Association of Realtors, the median down payment hasn’t been 20% since 2005. The current median down payment in 2021 is only 13%, and for first-time home buyers it’s even lower at 7%.

Today’s Median Down Payment from NAR

What Does This Mean for You?

The jig is up! The typical home buyer is putting far less down than 20%, which means you could be closer to your dream of owning a home than you realized. It’s incredibly important to gather as much information as you can on your pursuit of becoming a homeowner. Believe it or not, there are financing options available that offer lower down payments. With an FHA loan, you can put as little as 3.5% down! Are you a veteran? If so, you may be eligible for a VA loan with a 0% down payment option. To learn more about low payment options, click here.

Remember, a 20% down payment isn’t a requirement. If you want to purchase a home this year, let’s connect to start the conversation and explore your down payment options. Give us a call at 562-896-2456!